child tax credit november 2021 not received

If you have not yet claimed the benefit on your taxes you may be entitled to. So parents of a child under six receive 300 per month and parents of a child six or.

Child Tax Credit 2021 What To Know About New Advance Payments

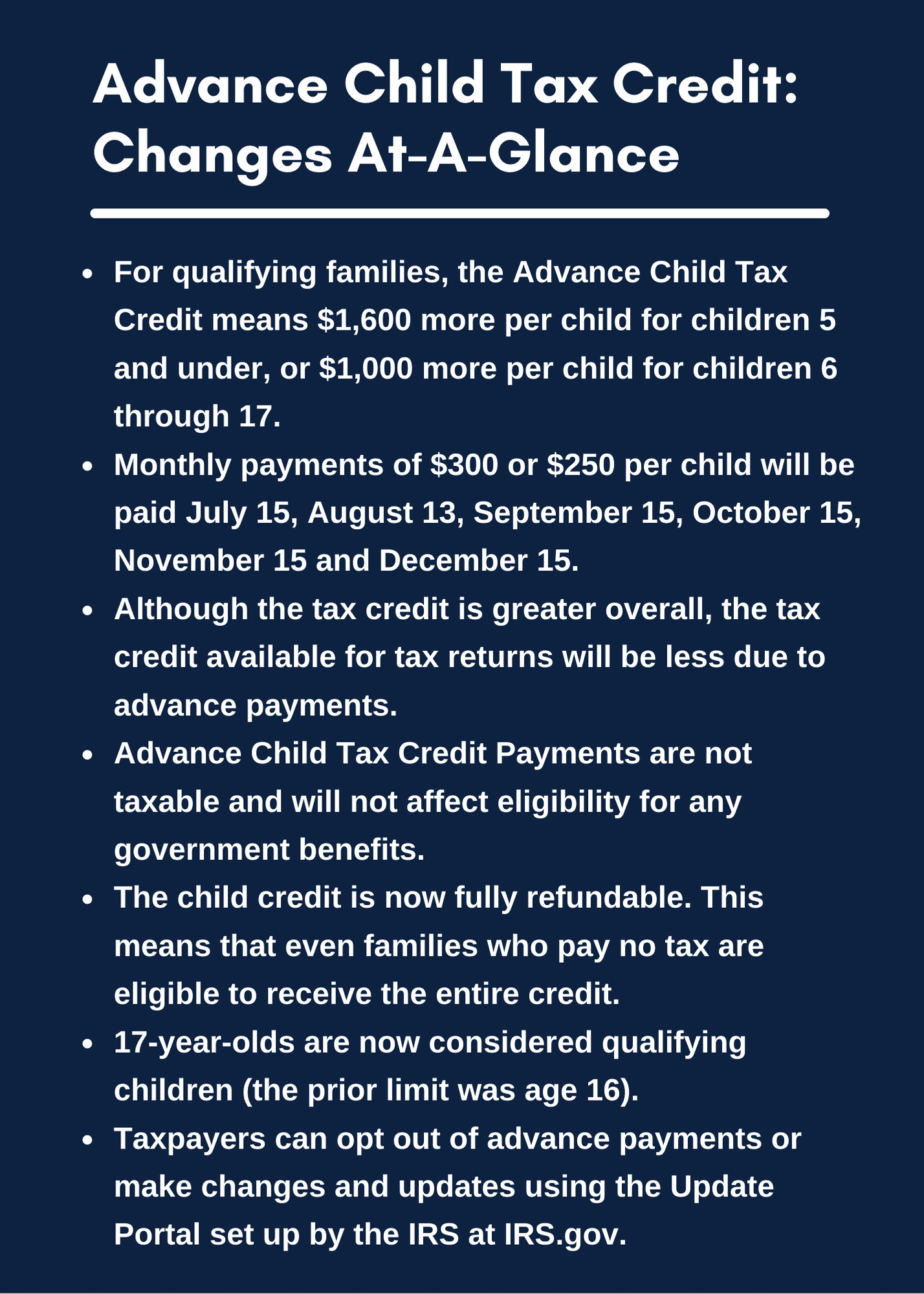

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of.

. Up to 300 dollars or 250 dollars depending on age of child. Theres good news for families who missed out on the payments for the child tax credit. He American Rescue Plan allowed for an increase in the Child Tax Credit f or the 2021 tax year.

For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year. To reconcile advance payments on. However you will simply receive all the previous months checks in one lump sum for half of the full benefit amount.

The IRS bases your childs eligibility on their age on Dec. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. ENHANCED federal child tax credits expired at the start of 2022 but families can still claim the extra cash if they didnt receive it last year.

CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday. Tue Nov 08 2022 LOGIN Subscribe for 1. November 15 SHOULD BE PAID.

November 12 2021 1226 PM CBS New York. Up to 300 dollars or 250 dollars depending on age of child. The payments stemmed from a temporary enhancement to the child tax credit that Congress enacted as part of the 19 trillion American Rescue Plan Act that passed in March.

For families with qualifying children who did not turn 18 before the start of this year the 2021 Child Tax Credit is. Most families are eligible to receive the credit for their children. For those who have yet to claim the benefit on their taxes you may be eligible to receive 3600 for each dependent under six and 3000 for each child ages six to seventeen.

This means Decembers payment will be 1800 if you sign. The last payment for 2021 was sent. The fifth advance child tax credit CTC payment is being disbursed by the IRS starting Monday sending an estimated 15 billion to around 36 million families the agency.

The full expanded child tax credit amount is 3000 for each qualifying child between ages 6 and 17 at the end of the 2021 tax year and 3600 for each qualifying child 5. 1 day agoWhen legislation expanding the child tax credit passed Congress in 2021 it received no GOP support in either the House or Senate. Half of the total is being paid as six monthly payments and half as a 2021 tax credit.

Families who received advance monthly payments in 2021 can file a tax return to get the rest of their.

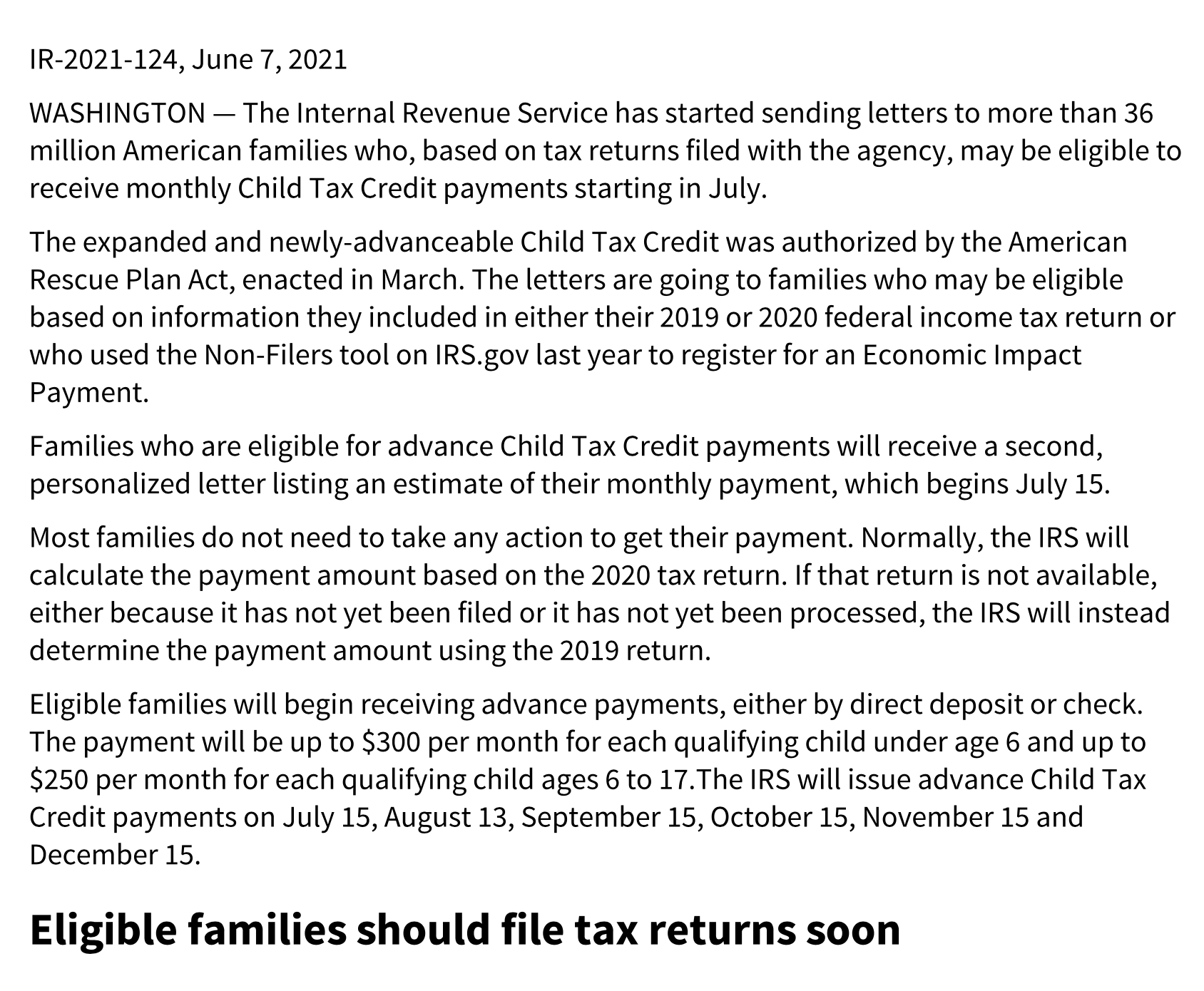

Irs Sending Letters To More Than 36 Million Families Who May Qualify For Monthly Child Tax Credits Payments Started July 15 Children Youth News Coconino Coalition For Children Youth

About The 2021 Expanded Child Tax Credit Payment Program

The Child Tax Credit Toolkit The White House

Letter Advanced Child Tax Credit Payments Allow Some Taxpayers To Stay Unemployed

Child Tax Credit 2021 What To Do If You Didn T Get A Payment Or Got The Wrong Amount Cbs News

Cdss On Twitter Hey California Get Money For Your Family If You Are Not Automatically Receiving Monthly Child Tax Credit Payments The Deadline To Sign Up Is November 15 Learn More Https T Co K1mgbg58m8

Late Child Tax Credit Payments From Irs Arriving Now Fingerlakes1 Com

Pros Cons Of Advanced Payments Of The Child Tax Credit Cn2 News

How The Advance Child Tax Credit Works And Who Can Claim The Credit Travis Raml Cpa Associates Llc

Advance Child Tax Credit Financial Education

Using The Child Tax Credit To Boost Your Banking

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

The Child Tax Credit The White House

Child Tax Credit Why You May Need To Opt Out Of 300 Payments By The November Deadline The Us Sun

What You Need To Know About The Child Tax Credit The New York Times

Advance Child Tax Credit Payments Coming To A Bank Account Or Mailbox Near You Accountant In Orem Salt Lake City Ut Squire Company Pc

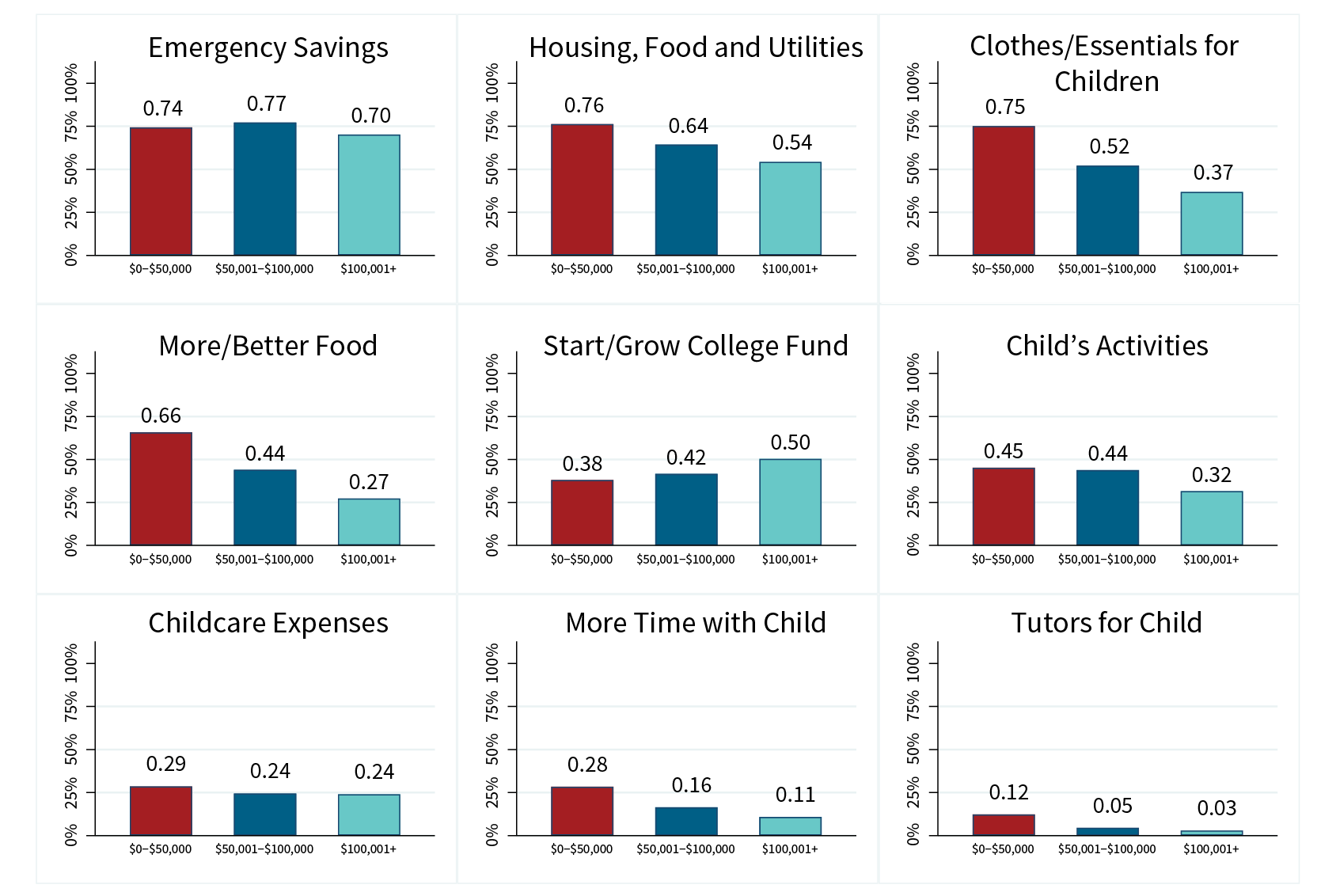

The New Child Tax Credit Does More Than Just Cut Poverty

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid 19 Policy Response Center On Budget And Policy Priorities