estate tax changes build back better

End Your Tax Nightmare Now. Senate Yet to Act December 3 2021 Earlier this fall we sent out an advisory regarding the.

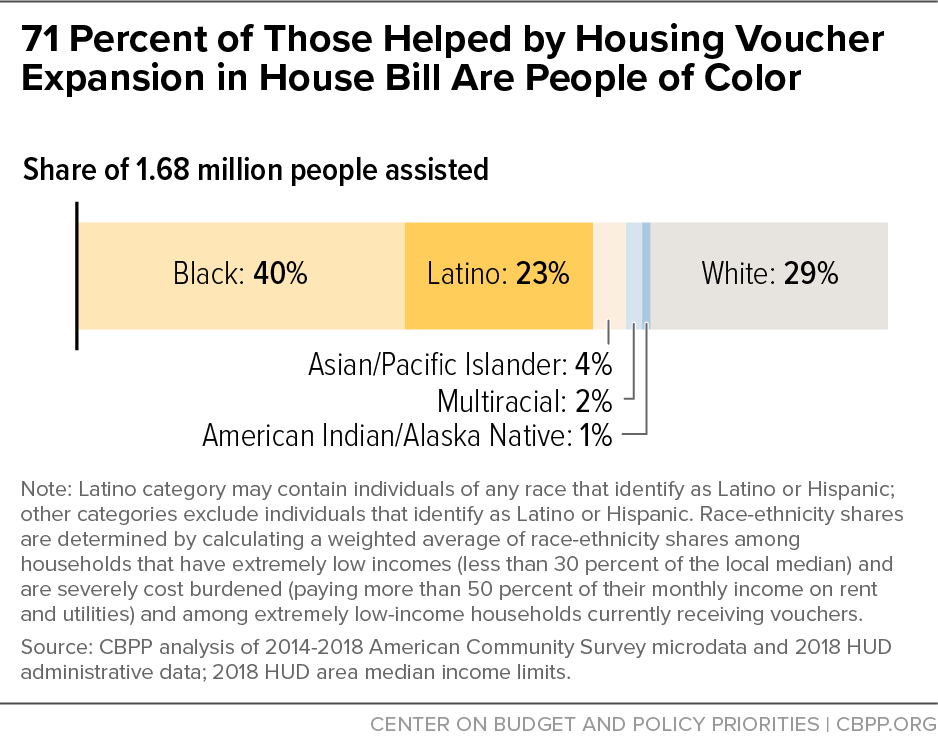

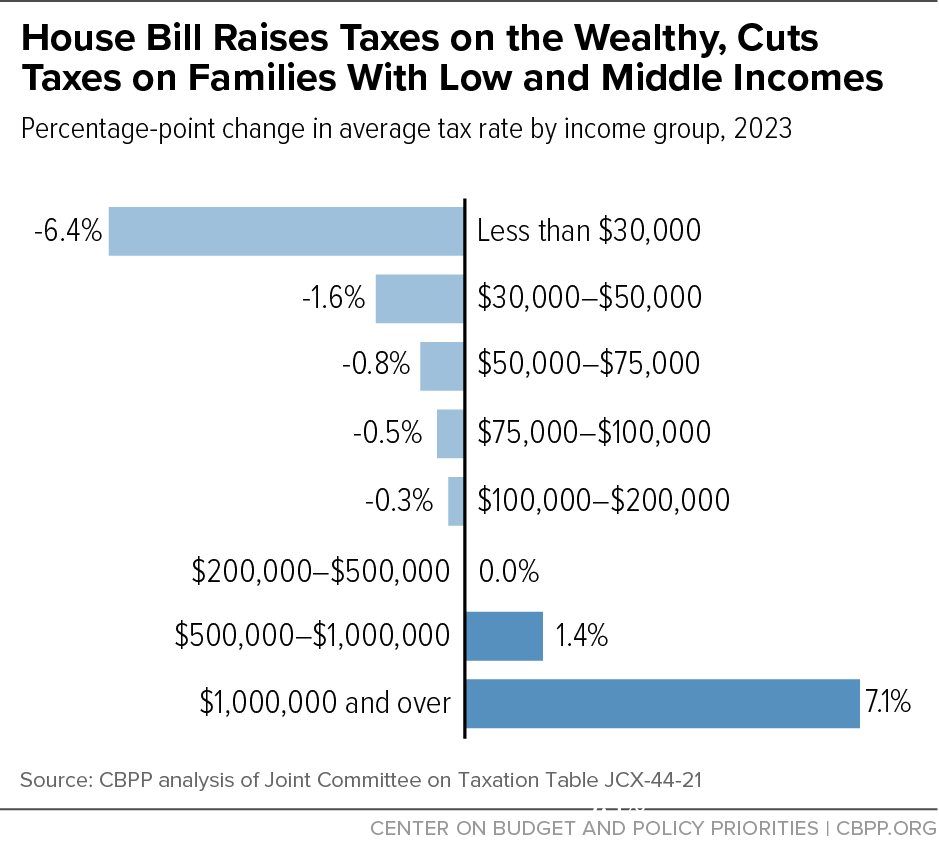

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock.

. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to. Estate and gift tax exemption. With inflation adjustments the exemption is 117 million in.

The TCJA doubled that exemption for 2018-2025. Tax system to raise revenue for a 175 trillion version of the Build Back Better Plan. Proposed Reduction in Federal Estate Tax Exemption Amount.

The AICPA told Congress about our concerns with the. House Bill Proposes Changes for Estate Planning Under the Build Back Better Act. Recommended - Free Evaluation Learn About Estate Planning Now.

House Bill Proposes Changes for Estate Planning Under the Build Back Better Act. 5376 the Build Back Better Act by a vote of 220213. Gift and Estate Taxes Proposed Under the Build Back Better Act.

A notable exception is the early Sept. Free Estate Planner Evaluation. Economic Effects of the Updated House Build Back Better Act While the latest proposal steers clear of some of the major tax rate increases of the original Ways and Means.

Lowering the gift and estate tax exemptions seems a lock. There are very few tax provisions in the act. The BBBA proposal seeks to reduce these.

Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way. 5376 commonly known as. Tax The House of Representatives on Friday morning passed HR.

The estate tax exemption was set at 5 million in 2011 adjusted for inflation. The upshot is to avoid these new grantor trust tax rules create and fully fund your grantor trust by the end of 2021. 30 sunset of the Employee Retention Credit ERC.

Understanding Other Proposed Changes Under the Build Back. The bill encompasses a wide range of budget and. 28 2021 President Joe Biden announced a framework for changes to the US.

Senate Yet to Act Friday December 3 2021 Earlier this fall we sent out an advisory regarding. Trusts and estates lawyers and advisors have been keeping a close watch on recent developments regarding the tax proposals contained in HR. Under the current tax laws the estate gift and generation-skipping transfer tax exemptions are already.

We analyze your financial picture provide a plan to achieve your estate planning goals. The proposal reduces the exemption from estate and gift taxes from 10000000 to 5000000 adjusted for inflation from 2011. Ad Committed to Delivering High-Quality Estate Trust Planning in a Fast and Effective Way.

Under the TCJA signed into law in 2017 the gift estate and GST tax exemptions were scheduled to decrease from 117 million per person currently in 2021 to 5 million per person plus. The BBBA proposal seeks to reduce these. Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists.

Ad Recommended -- 4 Simple Steps. The federal estate tax exemption is currently set at 10 million and is indexed for inflation. The estate planning community got some very good news on October 28 2021 when the Biden administration released its Framework for the Build Back Better Act.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Ad We Can Help Your Estate Planning With Guidance and Resources From Our Specialists. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs.

For decedents dying in 2021 this. Ad 5 Best Tax Relief Companies of 2022. Accelerated Reduction of the Estate Gift and GST Exemptions.

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

Could The Sec Climate Rule Help Carbon Taxation

Whatever This Is It Won T Be Build Back Better

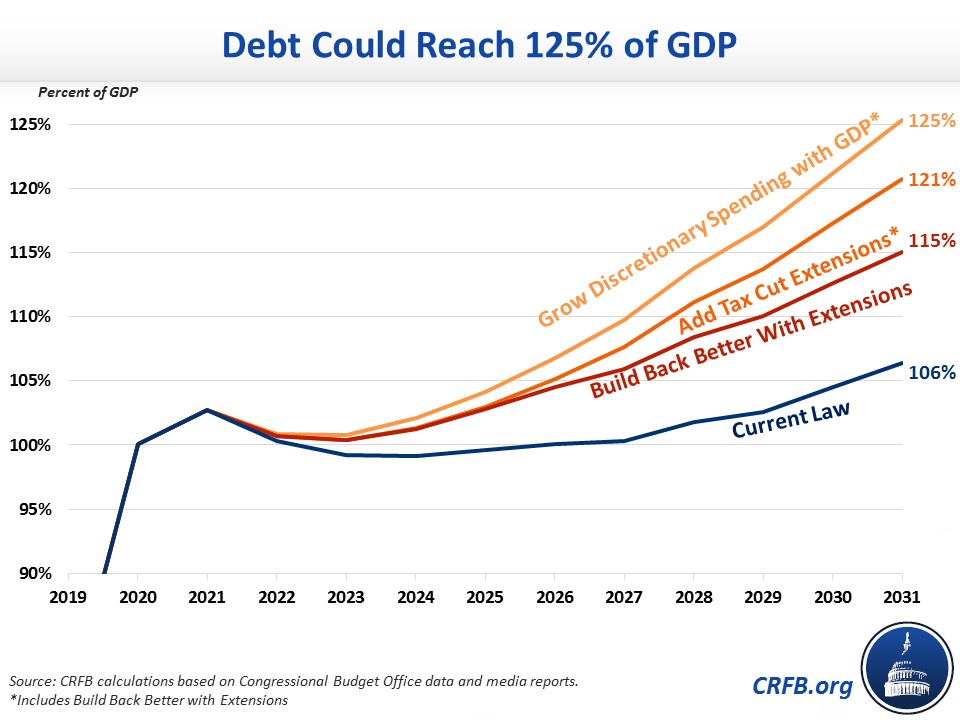

How Much Could Build Back Better Add To The Debt Committee For A Responsible Federal Budget

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

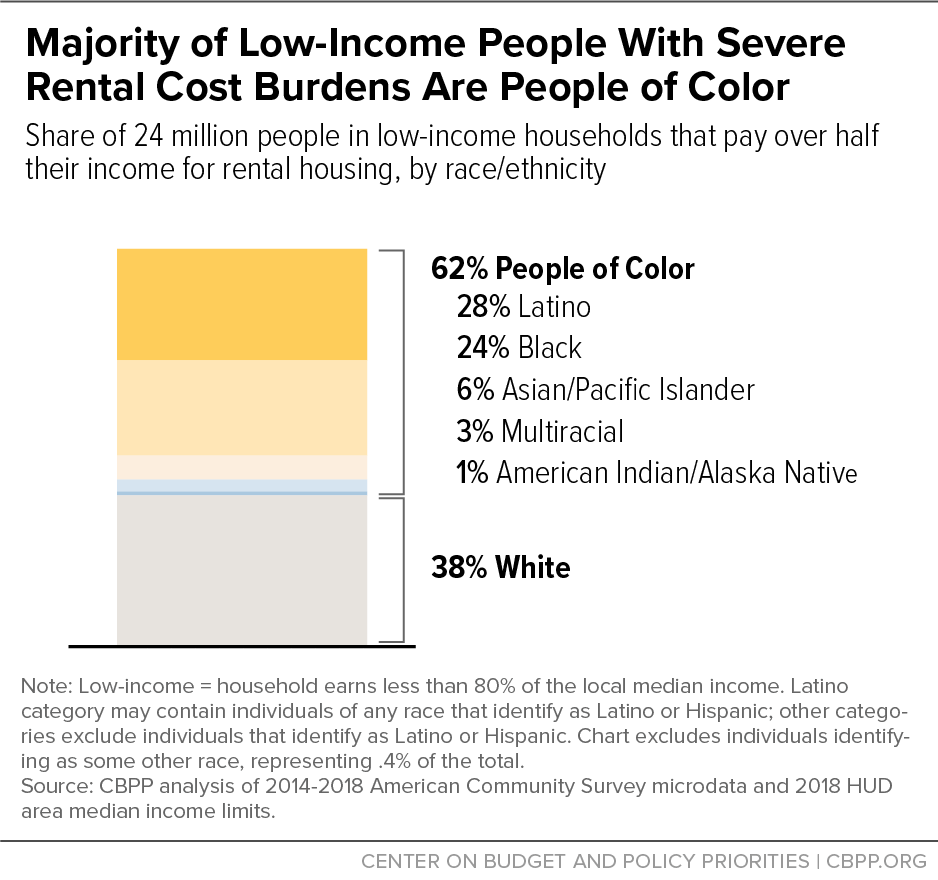

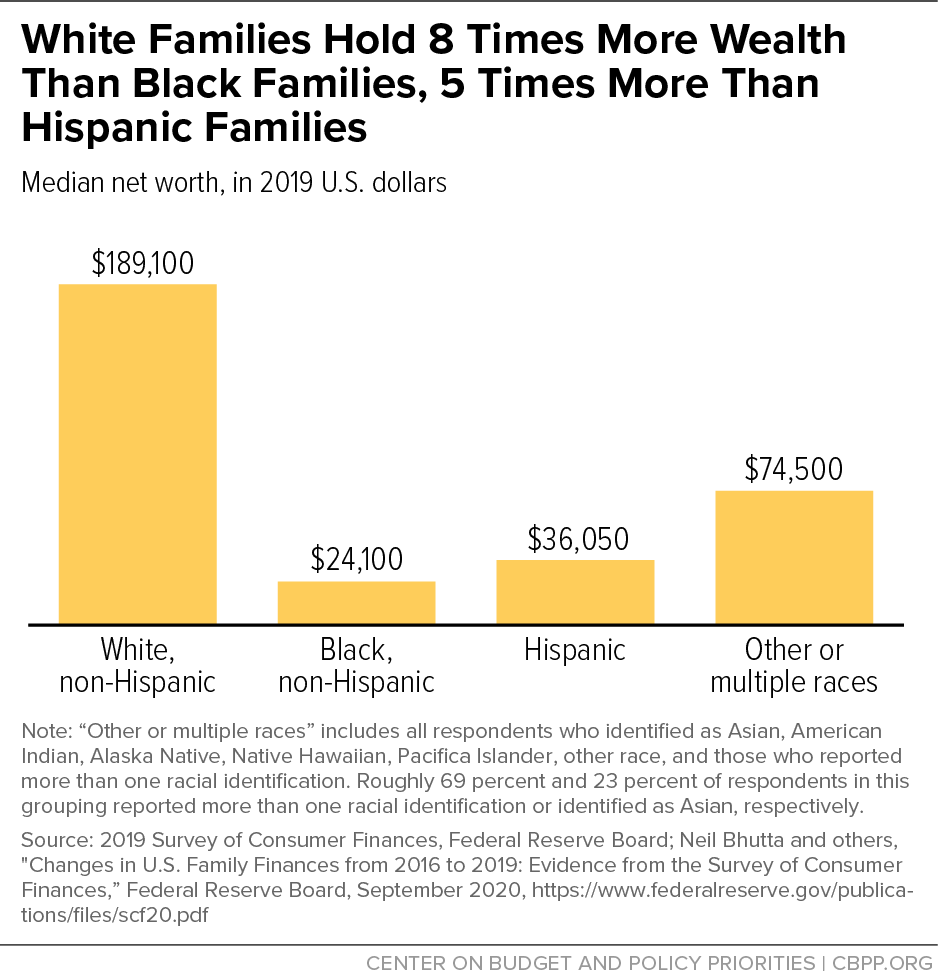

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

One Person Who Deserves Blame For Biden S Stalled Agenda Is Joe Biden The Washington Post

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Https Www Forbes Com Sites Peterjreilly 2021 09 25 Time To Change Your Estate Planagain Estate Planning Estate Tax Grantor Trust

Are Democrats Worth Their Salt Wsj

The Build Back Better Act Transformative Investments In America S Families Economy House Budget Committee Democrats

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch

To Build Back Better Tax Ultra Wealthy Families Like Ours Time

How Build Back Better Would Impact Housing Forbes Advisor

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Us Failure To Pass Build Back Better Act Imperils Rights Human Rights Watch